Space, a New Voyage for Palantir

Palantir joined forces with Voyager Technologies to develop and build the successor to the International Space Station. There's more.

Voyager Technologies, previously Voyager Space, partnered with Palantir in February of last year. You may have the following questions. What’s Voyager? What do they do? Why is Palantir working with them?

In a similar fashion to what Palantir did with SPACs some years ago, both companies partner to deliver a solution in a specific industry and perform so dramatically better compared to the other players that it instantly becomes an industry standard. The risk aspect with those SPACs and with Palantir holding a substantive percentage of the business was exposure to market capitalization changes and no guarantees that they would pay in the future due to low and uncertain revenue stream. The situation with Voyager is different. A consortium of companies (Boeing, Voyager, MDA, Mitsubishi and, of course, Palantir) came together to form a subsidiary, Starlab, with Palantir owning just 1% of it. Starlab is Voyager’s main bet for the next few years, and I’ll explain what it’s about in a bit.

Not only do we see connections with Palantir, but it’s also worth noting that Voyager’s current Chief Strategy Officer, Wallis Laughrey, previously worked at Anduril as the head of Anduril Labs.

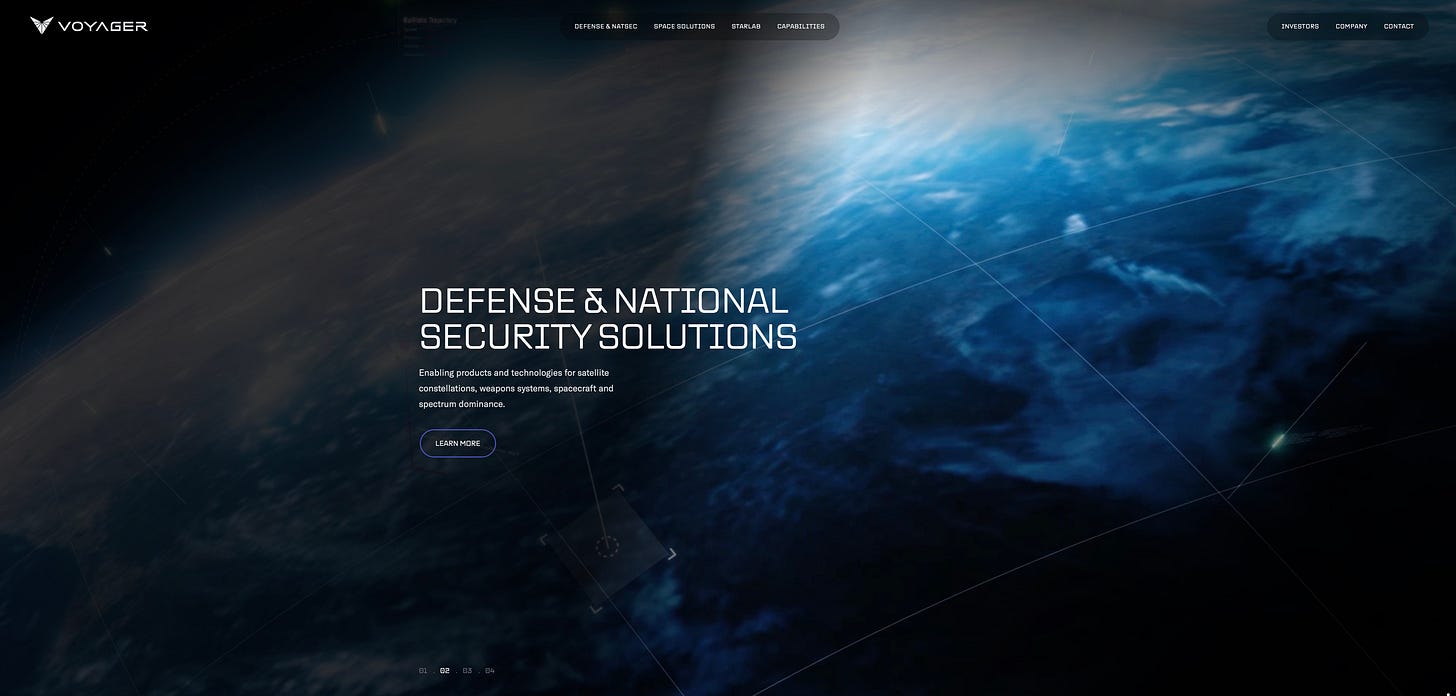

Voyager Technologies isn’t a newcomer that just now joined the space race, they’ve been around since 2019. One of their approaches was to buy what could have been seen as competition and used their expertise to develop what we are seeing today as unique Voyager products. For example, they take pride in owning the only commercial addition to the International Space Station: Bishop. Voyager has also performed impressively regarding missions to the ISS and number of nations and customers served.

So what’s Starlab? The International Space Station has been orbiting the earth for close to 30 years, and the passing of time shows, added to an increasingly obsolete technology. Voyager is one of three in consideration to replace the ISS, and NASA has been awarding hundreds of millions to them; Blue Origin, Axiom Space and Voyager, to develop and implement the necessary technologies for ultimately building the successor to the station, and Starlab is Voyager’s proposal.

We can see some similarities with what happened between Palantir and Airbus. There was an industry in need of a solution, and SkyWise was the response. In that case, however, it was a broad platform that was offered to virtually every airline that wanted to benefit from it. With Starlab we have a very different situation due to the hardware aspect and the status of sole alternative to the current ISS. Even if Palantir didn’t hold any share of the Joint Venture, Voyager still has access to Palantir software, primarily AIP, and will benefit from using it.

I remember when we all saw entities popping out in the commercial side and slowly but surely began implementing Foundry. We saw how companies like John Deere announced outstanding results just a mere quarter after gaining access to the platform. Then they began to promote Palantir as a no brainer, how they happily paid for it, generating and saving orders of magnitude above the cost of the software. Embedding themselves to the newly learnt language.

With a bit of luck, Voyager Technologies will be able to capitalize on their efforts and maybe in their first quarter results as a publicly traded company we will be shown the prowess of AIP in space. I’m especially excited to see how MetaConstellation is playing a role in their national defense offering.

I confess, I’m in awe of this company. As I’m looking for more and more data on them, I’m seeing good numbers and I began adding shares a couple of days ago. This is the first time since I began buying Palantir back in 2021 that I’ve bought shares of another company. I couldn’t care less of the fluctuation of the stock if it’s due to current geopolitical tensions, it’s normal, expected and has always happened. I’m also no market analyst, I just buy what I like and understand.

From a Defense & National Security perspective, we believe our solutions serve a total addressable market of $163 billion. Our serviceable addressable market is $11 billion. Our Space Solutions & Starlab Space Stations segments serve a total addressable market of $16 billion, of which we serve $1 billion. There are significant opportunities both in the U.S. as well as for allied international economics and governments.

Prospectus - Voyager Technologies, Class A shares offering

As per their own prospects, we’re talking about a TAM of around $190 billion, with market cap currently sitting at less than $3 billion with revenues exceeding $140M in 2024. Bear in mind, this is no promise of future projects, as I showed earlier, they are already delivering and have done so in more than 1,200 missions to the ISS and are rapidly expanding beyond that.

It’s an interesting company, to say the least, and it’s worth monitoring their activity. I’ll be doing just that, with a separate sheet inside of the DataBase.