This is the first report of what I’ve gathered on Lattice OS, Anduril’s platform for public safety, security and defense. This is the first of many more to come.

As I did with Palantir Foundry and AIP links, this will be a quarterly update. Since there’s still relatively low activity surrounding Anduril links, I’ll be publishing these reports at the very end of each quarter. For example, today is the 31st of March, so I’ll be publishing the report for Q1 today. In the future we could expect more saturated link activity, so the date may change to digest the data coming in.

As I explained in my previous Substack article, there were 33 unique Anduril links about a year ago. On March 17th that number was more than 2x. During the past 2 weeks, the unique entities list has increased ~10%.

That doesn’t include sub entries of these unique entities. For example, we have cases of a link belonging to a specific branch of the military, and then we see variations of the link, meaning there are different uses of Lattice for some of their clients. This makes me think of Foundry and its stickiness and how that allowed Palantir to make themselves indispensable and expand over their clients and their needs.

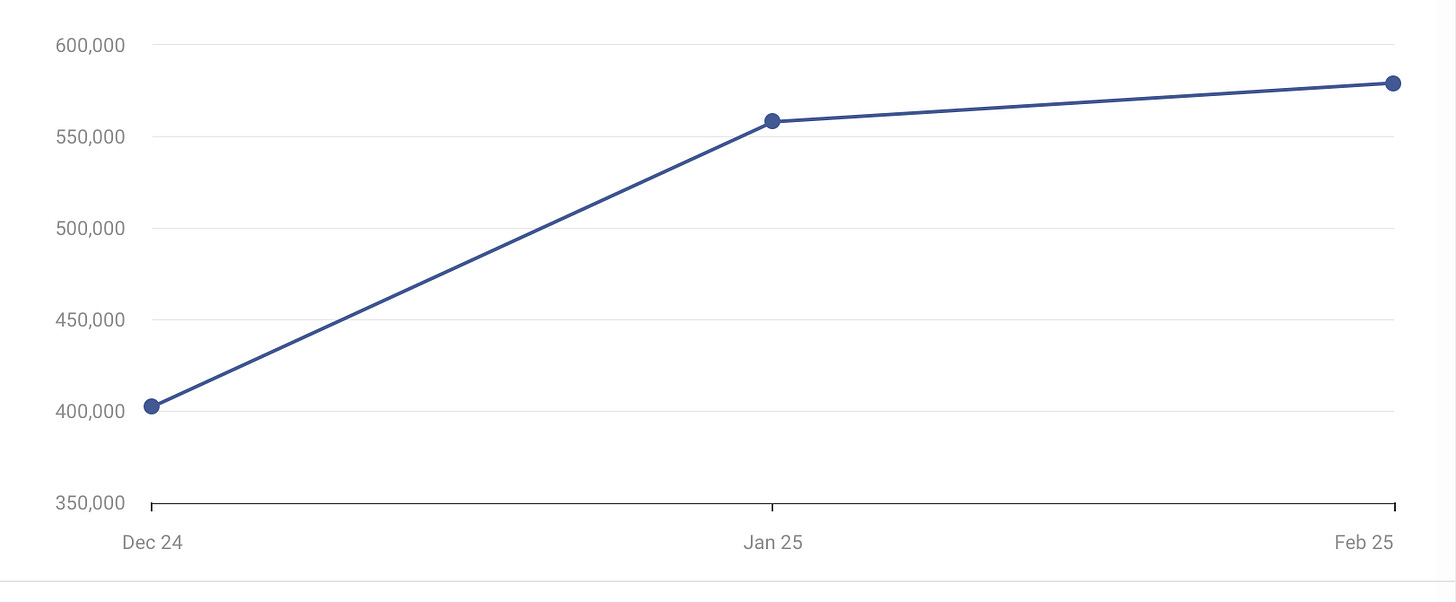

In the last 3 months there’s been a notable increase in visits to the Anduril main webpage, including in these domains directly related to commercial and government entities.

I’ve also began building 2 independent data sets inside of the DataBase concerning Commercial and Government clients. This list will be available and open, since these are public and known contracts. It’s just a place for us to visualize and have a full resourceful list. We’ll fill it with details, especially the government ones, so we can contrast with the link data and establish future correlations, just as we did with the Palantir DB.

In this report, I’ll publish the Government publicly known clients, the contracts, the date they announced them and the contract value, if known and available.

For this specific issue, I’m excluding contracts signed with specific states, such as Ohio and Texas, since the availability and the details of them are not so widely available. I’m still adding them to the DataBase and will be updating them separately.

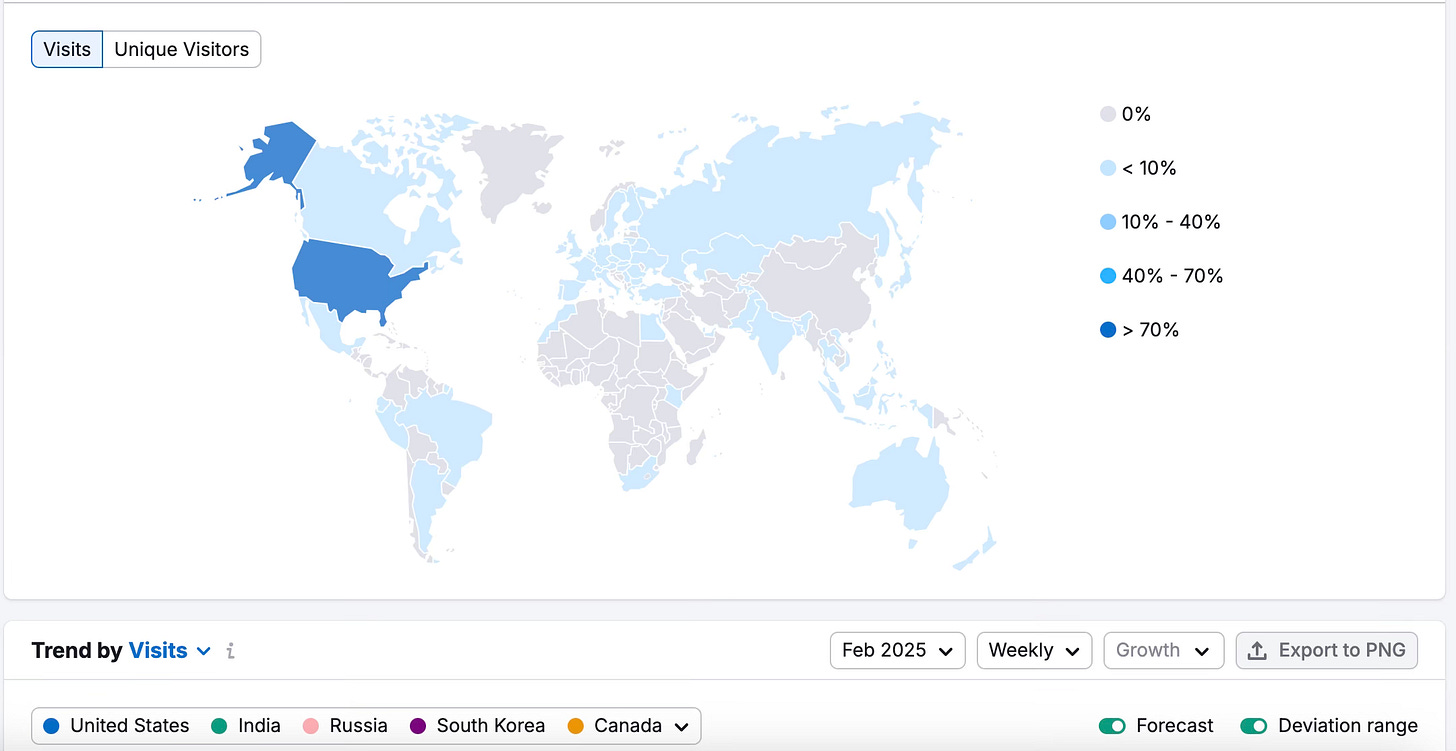

As a way to conclude this first Report on Anduril, I’ve chosen this visitor monitor that allows us to visualize where Anduril does the most work. The US has the most access with more than 70%, and I assure you this will be the norm for the next few years, if not decades, as the US is set to dominate the security and defense industry in the West.

I’ll keep updating you all with these Reports on Anduril and, as time passes, we will have more data, more reliability, more data sets and more sources so that we can perfect this DataBase that we are just starting.

Next Monday, I’ll be covering the new commercial contracts that Anduril is signing in a new article. I’ve already added these to the DataBase and I’m in the process of analyzing them.

I’m looking forward to Anduril going public in the (hopefully) not too distant future, so we can get access to fresh information and we can perfect this machine to predict clients, contracts and every single data point that can make us benefit from this information. Remember when we knew Palantir clients 3 months or even a year before they were announced? That’s where we can find ourselves with a company that’s not even public yet.

See you next week,

Either.