Expand and Scale: How Palantir Makes Money

Foundry is generating new revenue streams from existing customers, cutting the acquire phase in some instances.

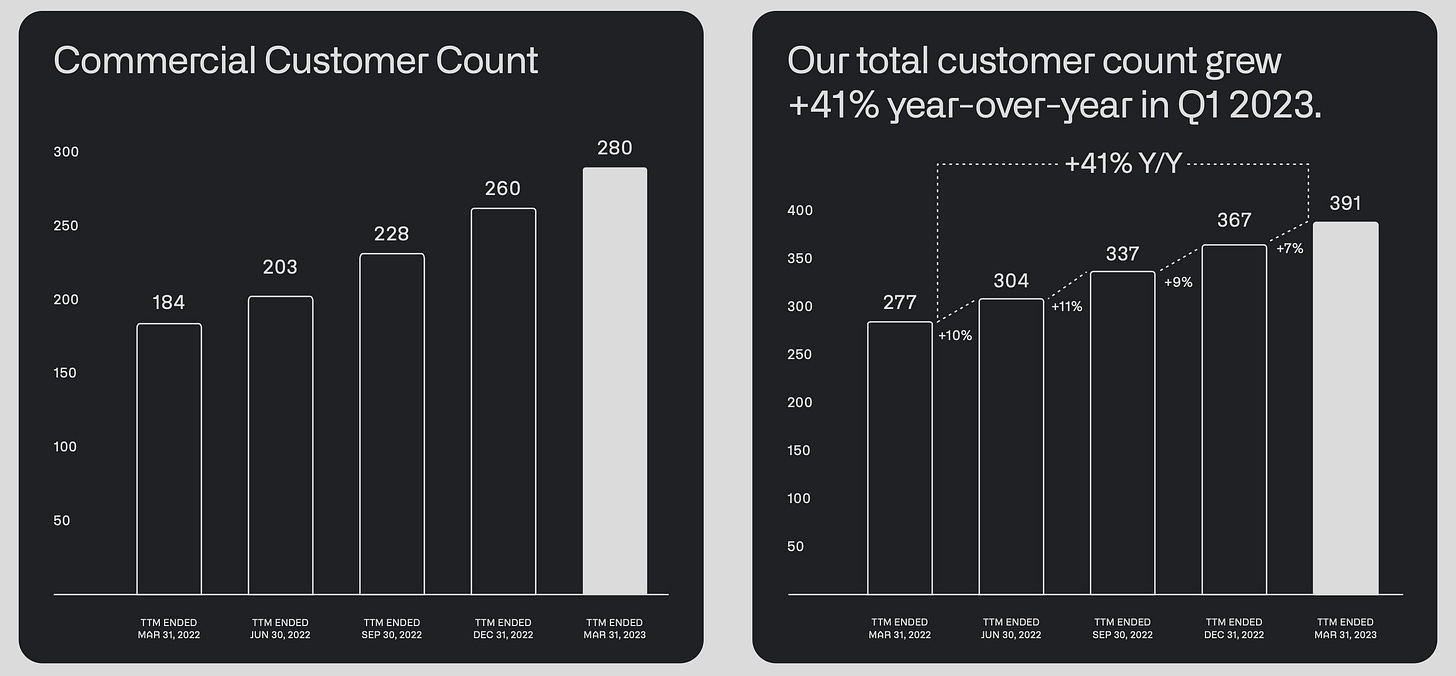

The one metric I always look for every 3 months in Palantir’s earnings reports is the number of clients added. That’s the most important piece of data for me, and lots of the major insights we get from the results come from there, like the average revenue per customer.

These last quarters, however, are showing us that there is another huge metric that doesn’t get very cleverly reported, and that is how Foundry is being used inside every corporation they do business with. And, most importantly, how these companies are finding new ways in which to make the most out of Foundry.

And that has everything to do with the last 2 of the 3 phases of Palantir’s business model; Acquire, Expand and Scale. Of course, the discourse focuses on the revenue growth that Palantir oversees every 3 months, and that is mainly driven by clients added, right? Well, not really, let me explain.

The true explanation of Palantir’s revenue growth lays behind the expansion of Foundry inside an already signed company and the ability that it has to scale and add to the revenue while adding virtually 0 cost. That is the secret behind Palantir over-delivering even if adding less clients than in the last quarter.

So why am I looking at clients added? First, because they signify future streams of revenues and the same thing that is happening to the huge names added in the last few months and years will happen to them, resulting in a catalyst few people are talking about. We also need to factor in the huge market cap names that are joining the Foundry family and also the fact that, just as Tyson did a couple of years ago, they will be able to comfortably pay for the product when the time comes, as Karp said on the call last week.

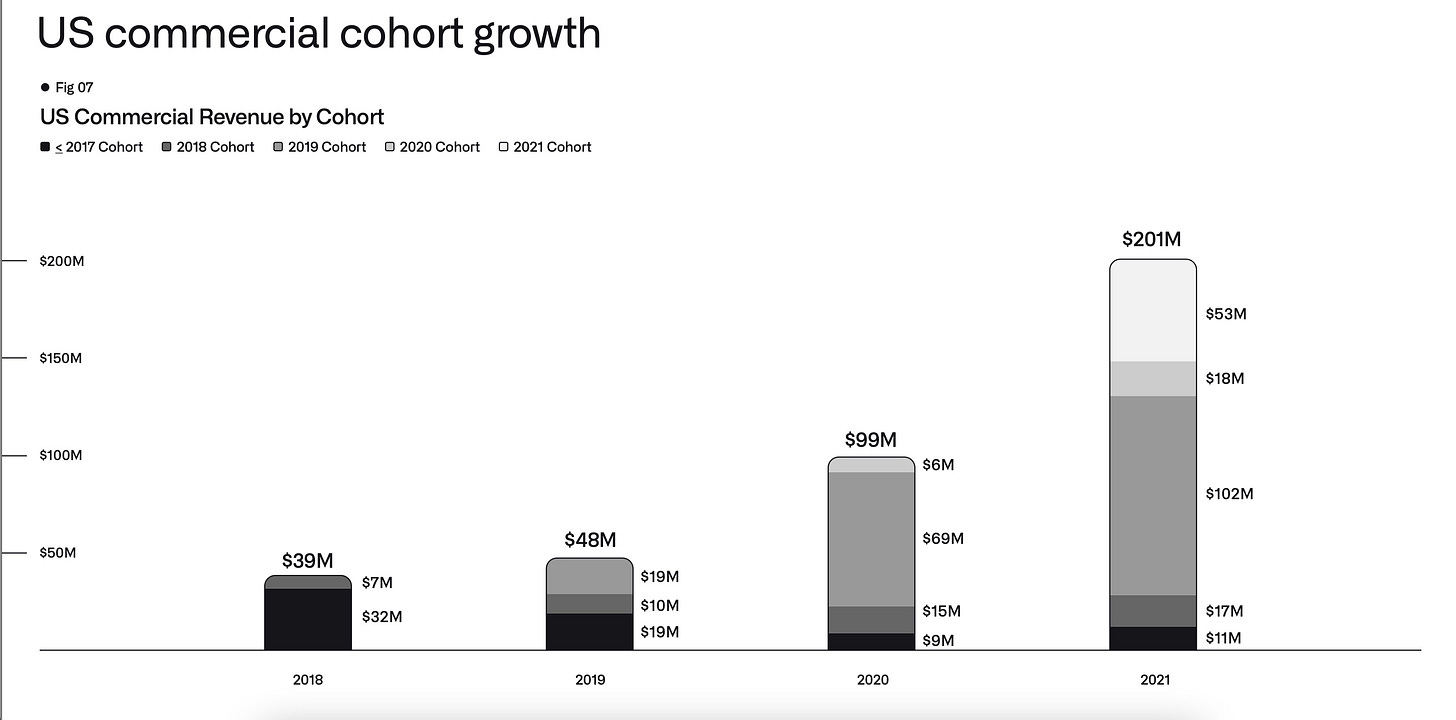

Just to visualize what I’m saying here, look at the US commercial cohort growth Palantir shared on February of last year, during the Q1 ‘22 earnings.

Look at the 2019 cohort. US commercial clients signed in 2019 represented $19M on that same year, while in just 1 year the revenue coming from those clients grew by 263%. In 2021 we saw a more modest but still impressive revenue growth, signifying an outstanding money intake just from clients signed 2 years back. Imagine taking into account the following years and stacking them together, and now think of the next 4 years. That’s what exponential looks like.

I wrote about Foundry’s stickiness 8 months ago, using the examples of Fujitsu and HSBC to show how companies use different configurations of Foundry for different needs in different departments, all inside of one company. The stickiness not only makes them like the product but there’ll come a time when the company needs it to survive, and adopting an alternative solution could result in a more expensive and less useful tool. Once you taste the fruit, you want the whole tree for yourself.

Well, I have a whole conceptual tree inside of the DataBase, a kind of Ontology (I call it FoundryMap), in which I’m gathering all entities that I’m able to relate to one same mother company or codename. Other than HSBC or Fujitsu, we can see a list with Coca-Cola, Hyundai and Roche entities, just to name a few, that are expanding every few weeks.

Using the analogy from before… For a tree to yield fruits it needs to be planted, it needs to grow and eventually it will produce food as long as it’s properly maintained.

In other words; Palantir needs to acquire the client, expand Foundry inside their business and scale it to eventually produce a strong stream of revenue as well as become a part of the company, to make it inseparable. A perfect win-win.